san mateo tax collector south san francisco

County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number. TurboTax Tax Experts Are On Demand To Help.

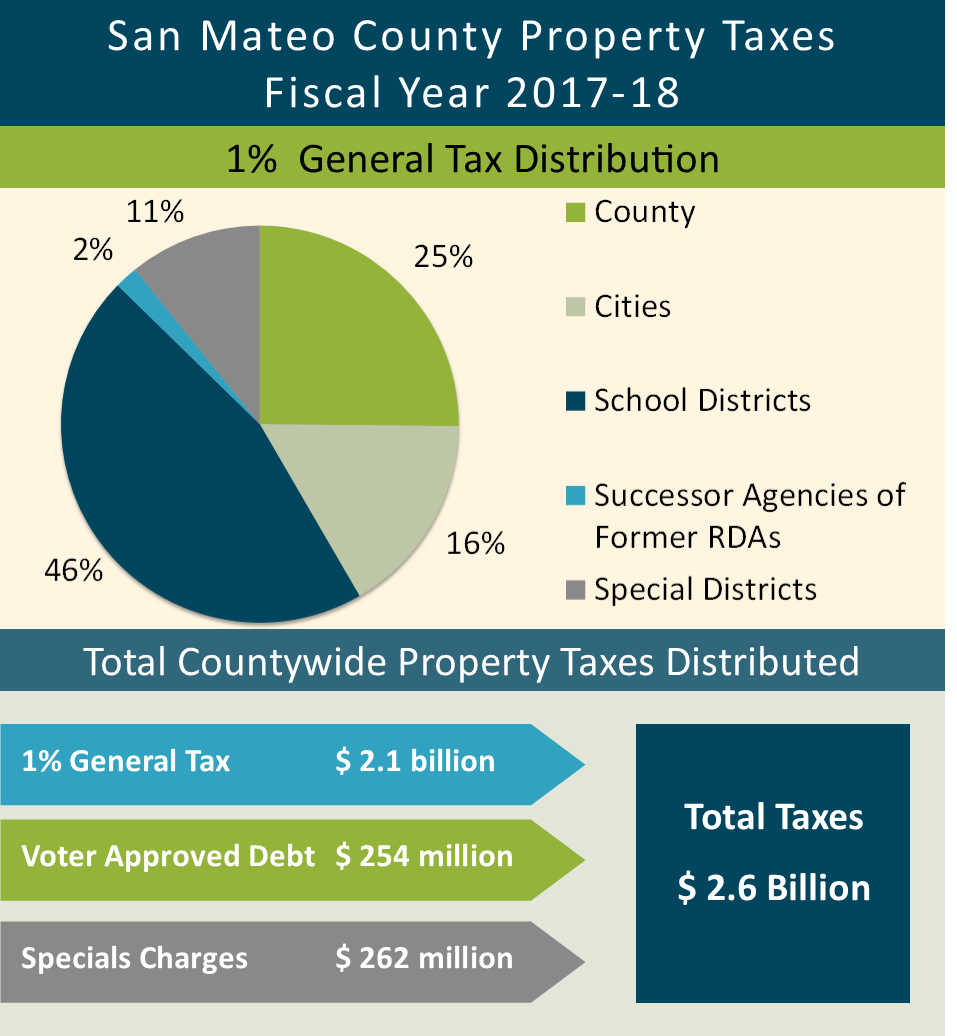

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

April 30 2020 910 pm.

. Collection Procedures for Transient. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. The local assessment roll is.

9 AM - 5 PM. The Superior Court ruled that the County Assessors Office had appropriately considered certain costs when it calculated. 1487 Huntington Avenue South San Francisco CA 94080 37644686 -122421524 Human Services.

1 of 4 Property taxes in San Mateo County are due Monday. Redwood City CA 94063. You also may pay your taxes online by ECheck or Credit Card.

San Mateo County Health Housing Department of Housing Human Resources Department. Taxing authority Rate Assessed Exemption Taxable Tax. 1487 Huntington Avenue South San Francisco CA 94080 Get Directions.

9 AM - 5 PM. With approximately 237000 assessments each year the Assessor Division creates the official record of taxable property local assessment roll shares it with the County Controller and Tax Collector and makes it publicly available. Vacancies and Apply Online.

The tax collector s office has been closed to the public during the shelter-in-place. Make Tax Checks Payable to. Ownership Information For property contacts like owners building management representatives from permits tenants and registered voters please register.

Property tax market value and assessed value exemptions abatements and assessment history. The current Conference Center Tax is 250 per room night. San Mateo County Health Housing Department of Housing Human Resources Department.

South San Francisco CA June 19 2018 Submitted by San Mateo County. SO SAN FRAN UNIF. 100 Accurate Expert Approved Guarantee.

See reviews photos directions phone numbers and more for San. Mail Tax Payments to. View information about 1431 San Mateo Ave South San Francisco CA 94080.

Make Tax Checks Payable to. 1423 San Mateo Avenue South San Francisco CA 94080 was built in 1965 and has a current tax assessors market value of 1562740. The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County.

April 30 2020 Updated. Levying authority Phone Number Amount. Redwood City CA 94063.

Click here for Property Tax Look-up. 555 County Center - 1st Floor. Name San Mateo Superior Court I Address 1050 Mission Road South San Francisco California 94080 Phone 650-877-5333.

All Boards. Tax Office Location. Phone Hours are 9 AM - 5 PM Monday - Friday Excluding all Holidays.

Access detailed property tax data for Mateo Avenue Mini - Mateo Avenue Mini - 1160 San Mateo Avenue South San Francisco. Tax returns are required monthly for all hotels and motels operating in the city. See if the property is available for sale or lease.

Ad File With Experienced Tax Experts Online From The Comfort Of Home. 1487 Huntington Avenue South San Francisco CA 94080 Get Directions. SAN MATEO TAX COLLECTOR - Courthouses - 1024 Mission Rd South San Francisco CA - Yelp.

See reviews photos directions phone numbers and more for San Mateo County Tax Collector locations in South San Francisco CA. SM JR COLL BOND S. Phone Hours are 9 AM - 5 PM Monday - Friday Excluding all Holidays.

555 County Center - 1st Floor. Sandie Arnott San Mateo County Tax Collector. FEDCANPDES STORM FEE 650 363-4100.

View photos public assessor data maps and county tax information. Address and Phone Number for San Mateo Superior Court I a Court at Mission Road South San Francisco CA. San Mateo Superior Court I Contact Information.

Tax Collector - Treasurer. Sandie Arnott San Mateo County Tax Collector. SSF SEWER 650 877-8555.

The current Transient Occupancy Tax rate is 14. All Boards. Office of the Treasurer Tax Collector.

Postmarks are imprints on letters flats and parcels that show the name of the United States Postal Service USPS office that accepted custody of the mail along with the state the zip code and the date of mailing. Tax Collector - Treasurer. The County of San Mateo has preserved approximately 95 million in property tax revenues for residents in a successful lawsuit against Genentech Inc.

Vacancies and Apply Online.

San Mateo County Property Values Rise Local News Smdailyjournal Com

320 Northwood Dr South San Francisco Ca 94080 Realtor Com

San Mateo County Property Values Reach Record High For 11th Year In A Row

Secured Property Taxes Tax Collector

210 E Grand Ave South San Francisco Owner Information Sales Taxes

Satelite Office Location Tax Collector

Juan Raigoza San Mateo County Controller Home Facebook

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

Presidio Terrace Homeowners Have Only Themselves To Blame Tax Boss Says

210 E Grand Ave South San Francisco Owner Information Sales Taxes

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

Satelite Office Location Tax Collector

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City